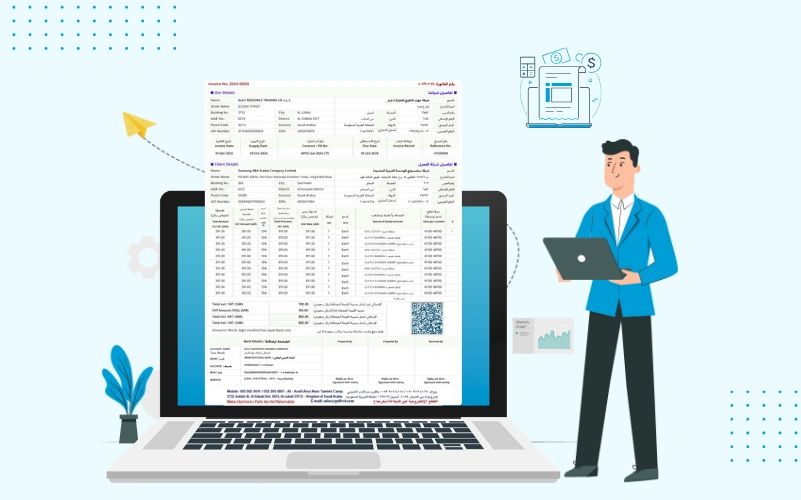

ZATCA E-Invoicing is a government mandate in Saudi Arabia that requires all VAT-registered businesses to replace paper invoices with digital e-invoices. This move aims to improve transparency, prevent fraud, and ensure proper tax compliance.

From small shops to large corporations, all businesses must issue invoices digitally using ZATCA-approved software. The e-invoices are created, stored, and reported in real-time to the ZATCA portal for better tracking and compliance

- Eliminates manual invoicing errors

- Improves tax filing accuracy

- Ensures legal compliance

- Helps you avoid fines and penalties

Why Choose Our ZATCA-Approved E-Invoicing Solution?

Our solution is certified by ZATCA and trusted by hundreds of Saudi businesses to handle all invoicing needs. It fully supports Phase 1 (Fatoorah Generation) and Phase 2 (Integration with ZATCA).

100% ZATCA Compliance

Generate XML-compliant e-invoices instantly that fully meet Saudi VAT laws and Phase 2 integration criteria.

User-Friendly Dashboard

Manage and create invoices effortlessly with an intuitive interface requiring no technical expertise.

Real-Time Invoice Reporting

Submit invoices directly to ZATCA, receive instant validation, and track invoice statuses live.

Secure Cloud Storage

All your data is encrypted and stored safely on regional servers ensuring privacy and regulatory compliance.

Branded Invoice Templates

Customize your invoices with your business logos, colors, and layout to reflect your brand identity professionally.

Cost & Time Saving

Eliminate paper and courier costs while accelerating your billing process to save money and valuable time.

Phase 1 – Fatoorah Generation

Since December 2021, all VAT-registered businesses must generate e-invoices in the correct ZATCA format.

Phase 2 – Integration Phase

Starting from 2023 (in rollout waves), businesses must integrate their invoicing system with ZATCA’s Fatoorah platform for real-time validation and reporting.

We ensure your software is ready for both phases, helping you avoid penalties and stay ahead of compliance deadlines.

Why Businesses in Saudi Arabia Trust Us

- Built specifically for the Saudi market

- Supports both Arabic and English invoices

- Easy setup and onboarding

- Detailed reporting and audit trail

- Local technical support and training

Ask Question

Request for Proposal (RFP)

Looking for expert solutions tailored to your business needs? Submit your Request for Proposal today, and our team will provide a detailed response.

- Fill out the form with your project details.

- Specify your requirements and expectations.

- Our team will review and respond with a tailored proposal.

Need assistance? Contact us at info@ausaftech.com.